The global lithium power battery market has witnessed significant fluctuations over the past few years, with prices affected by raw material costs, technological advancements, and supply chain dynamics. As we enter 2025, understanding the price trends of lithium power batteries, particularly LFP (Lithium Iron Phosphate) batteries for industrial vehicles, is crucial for businesses planning procurement and investment strategies.

Historical Price Trends of Lithium Power Batteries

Below is a table outlining the average price trends of lithium power batteries from 2020 to 2024, with a focus on LFP industrial vehicle batteries:

| Year | Average Lithium Battery Price (USD/kWh) | LFP Industrial Vehicle Battery Price (USD/kWh) |

|---|---|---|

| 2020 | 137 | 125 |

| 2021 | 132 | 120 |

| 2022 | 118 | 108 |

| 2023 | 105 | 95 |

| 2024 | 98 | 90 |

Factors Influencing Lithium Battery Prices

Several key factors have influenced the price fluctuations of lithium power batteries over the past few years:

- Raw Material Costs: The prices of lithium, nickel, and cobalt significantly impact battery costs. LFP batteries, which do not require nickel or cobalt, have seen more stable pricing.

- Technological Advancements: Improvements in battery energy density and manufacturing efficiency have contributed to price reductions.

- Supply Chain Disruptions: COVID-19, geopolitical tensions, and raw material shortages have caused temporary spikes in prices.

- Government Policies: Incentives for electric vehicles (EVs) and industrial electrification have driven demand, affecting pricing dynamics.

2025 and Beyond: Future Price Projections

Based on market trends and industry analysis, the price of lithium power batteries is expected to continue decreasing in 2025 and beyond. Analysts predict the following price trends:

| Year | Projected Lithium Battery Price (USD/kWh) | Projected LFP Industrial Vehicle Battery Price (USD/kWh) |

|---|---|---|

| 2025 | 90 | 85 |

| 2026 | 85 | 80 |

| 2027 | 78 | 75 |

| 2028 | 72 | 70 |

Key drivers for this continued decline include:

- Increased production capacity and economies of scale.

- Greater adoption of LFP chemistry in industrial applications.

- Recycling and second-life battery utilization reducing demand for raw materials.

SPIDERWAY LFP Industrial Vehicle Batteries: Performance, Capacity, and Pricing Advantages

SPIDERWAY is a leading provider of high-performance LFP lithium power batteries, specializing in industrial vehicle applications such as electric forklifts, aerial work platforms (AWPs), ground support equipment (GSE), golf carts, floor scrubbers, small marine vessels, and RVs.

Key Advantages of SPIDERWAY LFP Batteries:

- High Energy Efficiency: Enhanced cycle life with over 4,000 charge-discharge cycles.

- Superior Safety: LFP chemistry ensures thermal stability and lower fire risk.

- Fast Charging: Supports rapid charging capabilities for industrial operations.

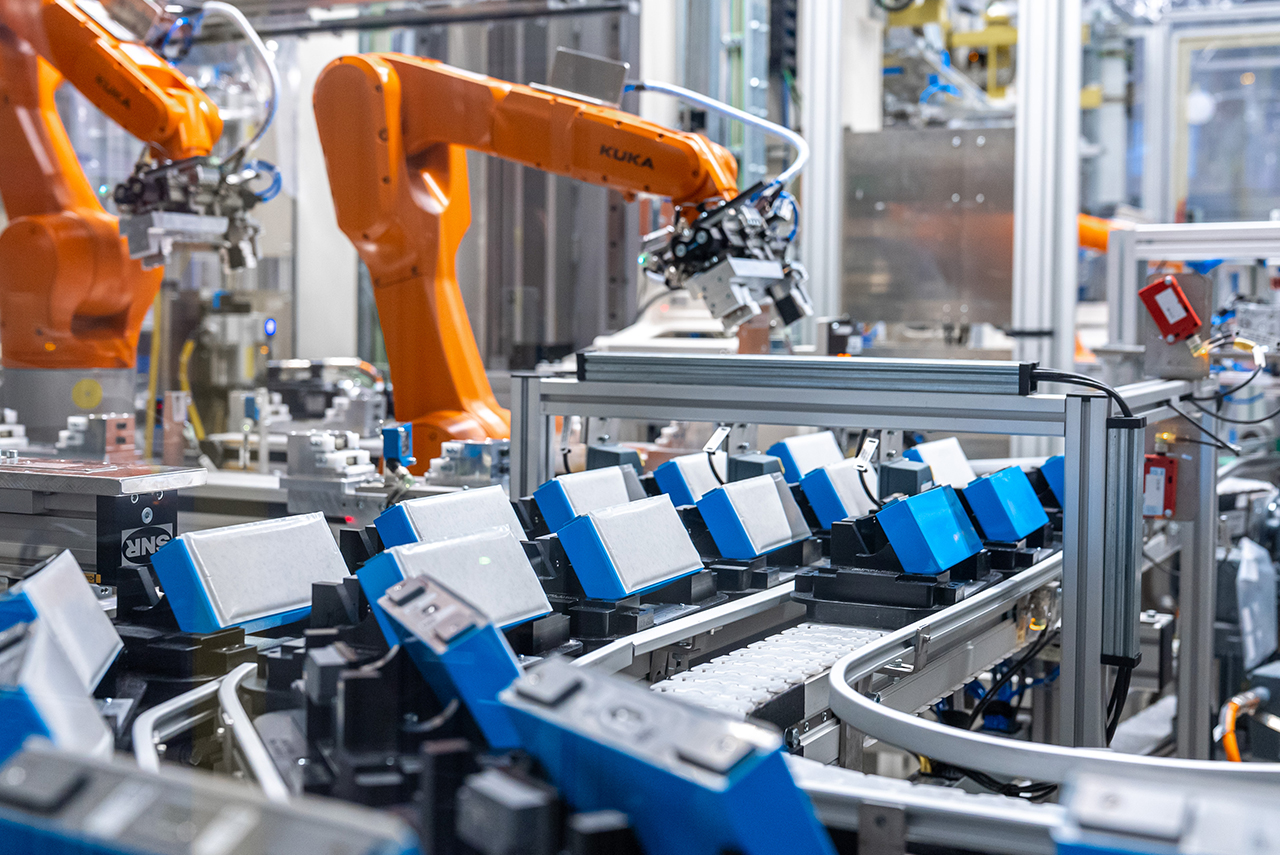

- Robust Manufacturing Capacity: SPIDERWAY operates state-of-the-art production facilities with an annual capacity of GWh-level output, ensuring reliable supply and competitive pricing.

- Cost-Effective Solutions: SPIDERWAY’s optimized production and supply chain efficiency allow for high-quality batteries at industry-leading prices.

Conclusion

The 2025 lithium power battery price trends indicate a continued decline, making LFP batteries more affordable for industrial applications. With SPIDERWAY LFP industrial vehicle batteries, businesses can benefit from high performance, safety, and cost advantages, ensuring a reliable and future-proof energy solution for electric industrial vehicles and equipment.

For inquiries about SPIDERWAY LFP battery solutions, pricing, and bulk orders, visit SPIDERWAY official website or contact us today.

https://www.spider-way.com/2025-lithium-power-battery-price-trends-market-analysis-and-future-outlook/?_unique_id=67e75b369d62c

Comments

Post a Comment