China continues to lead the global lithium battery market, with 2024 witnessing significant growth in exports. This article delves into detailed export data, market segmentation, product distribution, and year-over-year comparisons, focusing particularly on industrial vehicles powered by Lithium Iron Phosphate (LFP) batteries. Let’s explore the key insights and trends that defined China’s lithium battery export landscape in 2024.

Key Export Data and Trends in 2024

China’s lithium battery exports reached $45 billion, marking a 15% increase compared to 2023. The following table highlights the export growth across major regions:

| Region | Export Value (2023) | Export Value (2024) | Year-over-Year Growth |

|---|---|---|---|

| Europe | $15 billion | $18 billion | 20% |

| North America | $12 billion | $13.8 billion | 15% |

| Asia-Pacific | $8 billion | $9.6 billion | 20% |

| Middle East & Africa | $5 billion | $5.6 billion | 12% |

| South America | $2 billion | $2 billion | 0% |

Trends:

- Europe emerged as the largest importer, driven by EV adoption and green energy policies.

- Demand for Lithium Iron Phosphate (LFP) batteries outpaced other types due to safety, affordability, and sustainability factors.

Market Segmentation by Product Type

The lithium battery export market comprises multiple segments. Below is the 2024 product distribution:

| Product Type | Market Share |

|---|---|

| EV Batteries | 60% |

| Industrial Vehicle Batteries | 20% |

| Consumer Electronics | 15% |

| Energy Storage Systems (ESS) | 5% |

Notably, the industrial vehicle battery segment grew by 25%, highlighting the rising demand for LFP batteries in forklifts, automated guided vehicles (AGVs), and heavy-duty machinery.

Year-over-Year Comparison (2023 vs. 2024)

| Category | 2023 Market Share | 2024 Market Share | Change |

|---|---|---|---|

| LFP Batteries | 45% | 55% | +10% |

| NMC (Nickel-Manganese-Cobalt) | 40% | 35% | -5% |

| Other Chemistries | 15% | 10% | -5% |

The shift toward LFP batteries reflects the market’s preference for cost-efficient and stable chemistries suitable for industrial and energy storage applications.

Spotlight: Industrial Vehicle LFP Batteries

Industrial vehicle batteries accounted for $9 billion of China’s lithium battery exports in 2024, a 25% increase from 2023. LFP batteries dominate this sector due to their:

- Enhanced safety: Reduced risk of thermal runaway.

- Longer cycle life: Ideal for heavy-duty and high-frequency operations.

- Cost-effectiveness: Lower production costs compared to NMC batteries.

Key applications include:

- Forklifts and warehouse equipment.

- Mining vehicles.

- Construction and agricultural machinery.

Future Outlook and Trends

China’s lithium battery export market is projected to grow further, fueled by:

- Global electrification: Increasing adoption of EVs and renewable energy.

- Technological advancements: Innovations in LFP battery performance.

- Supply chain expansion: Strategic partnerships and localized production in key markets.

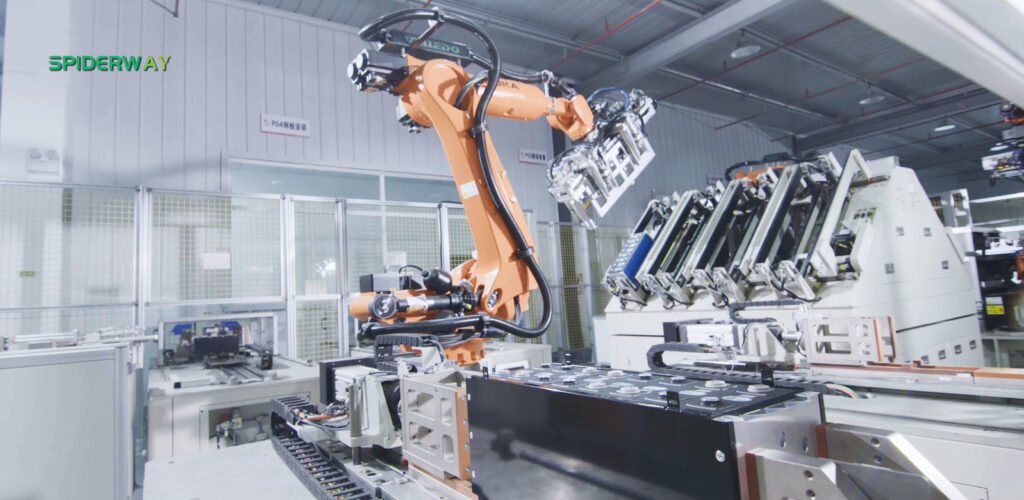

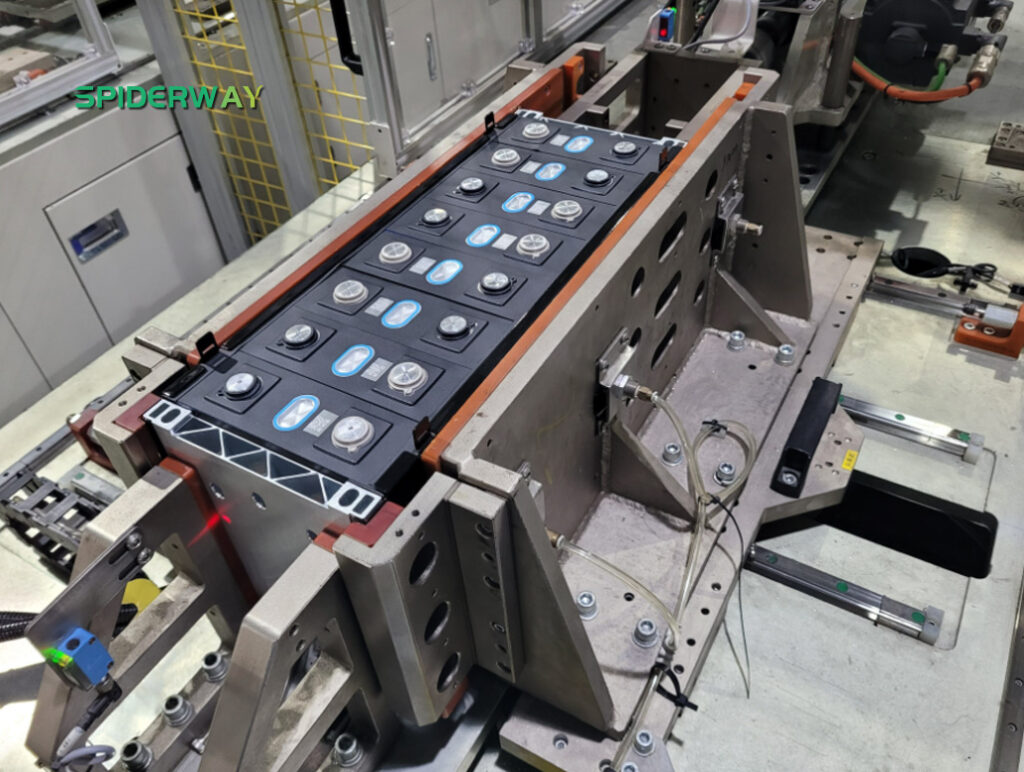

Introducing SPIDERWAY: A Leader in LFP Industrial Vehicle Batteries

SPIDERWAY is at the forefront of LFP battery technology, delivering high-performance solutions tailored for industrial vehicles. Our batteries are:

- Durable: Engineered for rigorous applications.

- Reliable: Consistent power output in demanding environments.

- Eco-friendly: Compliant with global sustainability standards.

Discover SPIDERWAY’s cutting-edge LFP battery solutions and transform your industrial operations. Visit us at SPIDERWAY to learn more.

By focusing on reliable data, advanced technology, and customer-centric innovation, SPIDERWAY continues to empower industries worldwide. Let’s shape the future of electrification together.

https://www.spider-way.com/2024-chinese-lithium-battery-export-data-overview-market-trends-and-key-insights/?_unique_id=67e588d4607f9

Comments

Post a Comment